[updated 23.12.25]

Cocoa arrivals keep prices steady

Cocoa prices have remained more or less stable since our last report in October. Increased cocoa arrivals at ports in the Ivory Coast are bearish for cocoa prices. Monday's government data showed that Ivory Coast farmers shipped 970,945 MT of cocoa to ports from Oct 1st through to Dec 21st, down -0.1% from 970,945 MT in the same period a year ago. The Ivory Coast is the world's largest cocoa producer.

A boost to West-African harvests

Favourable weather in West Africa has helped with cocoa harvests. Cocoa farmers in the Ivory Coast have reported that a mix of rain and sunshine is helping cocoa trees bloom, and farmers in Ghana said rains have been regular and helpful to cocoa tree and pod development ahead of the harmattan season. The cocoa pod count remains approximately 7% above the 5 year average and the bean quality appears to be good.

Global surplus forecasts trimmed

On November 28, the International Cocoa Organization (ICCO) cut its global 2024/25 cocoa surplus estimate to 49,000 MT from a previous estimate of 142,000 MT. It also lowered its global cocoa production estimate for 2024/25 to 4.69 MMT from 4.84 MMT previously. In addition, Rabobank on Tuesday cut its 2025/26 global cocoa surplus estimate to 250,000 MT from a November forecast of 328,000 MT.

Delay to European deforestation law

The European Parliament on November 26 approved a one year delay to the deforestation law, keeping cocoa supplies ample. The EU regulation, known as EUDR, aims to tackle deforestation in countries whose imports into the EU include key commodities such as soybeans and cocoa. The delay of the EUDR will allow EU countries to continue importing agricultural products from regions in Africa, Indonesia, and South America where deforestation is occurring.

A rise in compound chocolate

Weak global cocoa demand is helping to keep prices lower. Demand has dropped across all continents and major chocolate companies have redeveloped some of their most popular brands such as Toffee Crisp, Penguin, Jacob’s Club and Blue Riband to be coated with compound chocolate rather than real chocolate. This will also contribute to a drop in demand for real chocolate. Compound chocolate is made using cocoa powder and other fats rather than cocoa butter. The result will be more availability of cocoa butter which means we will see white and milk chocolate, that use more cocoa butter in their recipes, drop further in price than dark chocolate.

Sweeter savings ahead

What does this mean for chocolate prices at Henley Bridge Ingredients going into 2026? Prices from our main chocolate suppliers will be dropping by an average of 12-20% so from February 2026 we will be passing these savings on to all our customers.

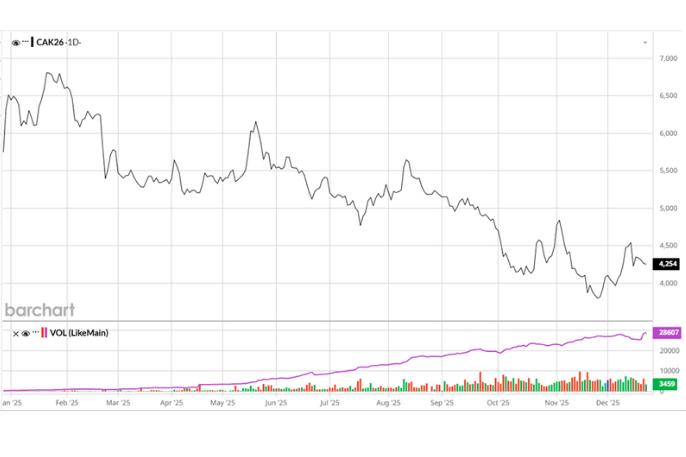

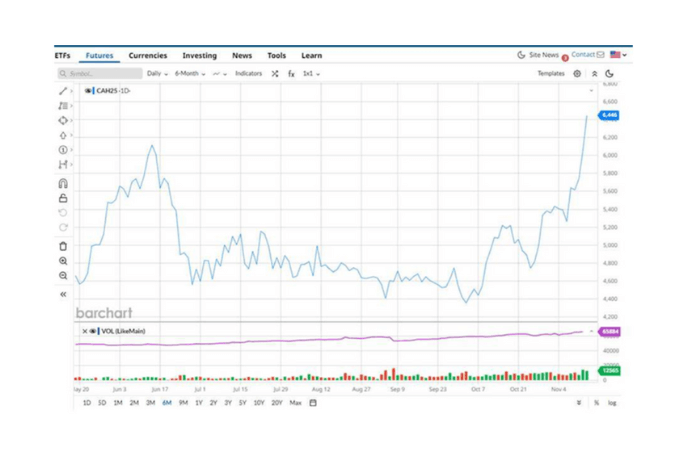

Current cocoa graph:

[updated 16.10.25]

Cocoa prices take a sharp dip

Cocoa prices settled sharply lower yesterday due to concerns about weak global cocoa demand. Malaysia's Q3 2025 cocoa grindings dropped 35% year on year. Today at 8am the European 3rd quarter 2025 grindings were announced and there was a decrease of 4.79%. The Cocoa Association of Asia (CAA) will publish their 3rd Quarter grindings on Friday 17th October. While for America, the National Confectioners Association (NCA) will publish their 3rd Quarter grindings today (16th October) at 16.00pm NY Time. General expectations in the market are for the aggregate figure to range from a conservative decline of -5% to as much as -15%. The results of the other grinding regions are needed for a consolidated view on total production. Following todays European Q3 grindings figures the London cocoa market initially increased by +£150/mt settling down to +£85/mt at the time of writing to £4,200/mt. This is a total drop of nearly £3,000/mt compared to January 2025’s peak of £7,100/mt.

Signs of a stronger Ivory Coast crop

The outlook for an improved cocoa crop in the Ivory Coast this year is also beneficial for prices. Chocolate maker Mondelez recently said that the latest cocoa pod count in West Africa is 7% above the five-year average and "materially higher" than last year's crop. The harvest of the Ivory Coast's main crop has only just begun but farmers are optimistic about the quality of the crop.

Ghana's cocoa boom lowers prices

Expectations of increased global cocoa supplies are lowering cocoa prices. Cocoa deliveries in Ghana have surged. Cocoa arrivals to ports in Ghana in the four weeks ending September 4 reached 50,440 MT compared to about 11,000 MT delivered in the same period in 2024. Ghana is the world's second largest producer of cocoa.

The outlook for pricing into 2026

What does this mean for chocolate prices? At Henley Bridge Ingredients we have seen general chocolate prices come down in the second half of 2025 by approximately 10-20% which we have passed on to our customers. If the cocoa market stays around the +/- £4,000/mt mark or drops further we could see further price drops going into 2026.

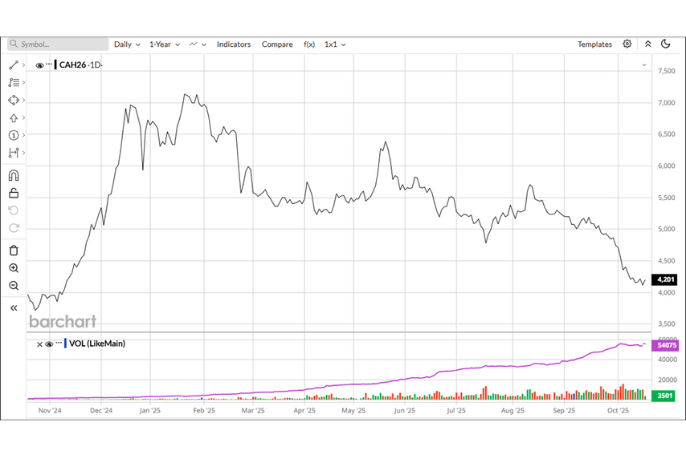

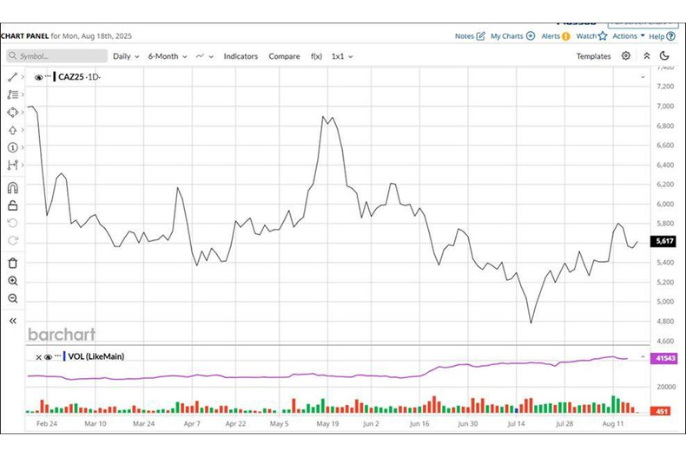

Current cocoa graph (as of 14:00pm GMT Thursday 16th October):

[updated 20.08.25]

Weather affects on cocoa crops

There are still concerns about dry weather in West Africa that threatens the cocoa crops. There has been little to no rain over the past few weeks in the cocoa-growing areas of the Ivory Coast and Ghana, which could negatively impact the development of cocoa plants. Rainfall in the Ivory Coast and Ghana this season remains below the 30-year average, and combined with high temperatures, could hurt cocoa pod development for the main crop harvest that starts in October.

There has also been a slowdown in cocoa exports from the Ivory Coast. Ivory Coast farmers shipped 1.78 MMT of cocoa to ports this marketing year from October 1 to August 10, up +6.6% from last year but down from the much larger +35% increase seen in December.

Exports and quality challenges

There are still quality concerns regarding the Ivory Coast's mid-crop cocoa, which is currently being harvested through September. Processors are complaining about the quality of the crop and have rejected truckloads of Ivory Coast cocoa beans. Processors reported that about 5% to 6% of the mid-crop cocoa in each truckload is of poor quality, compared with 1% during the main crop. The poor quality of the Ivory Coast's mid-crop is partly due to late-arriving rain in the region, which limited crop growth. The mid-crop is the smaller of the two annual cocoa harvests, which typically starts in April. The average estimate for this year's Ivory Coast mid-crop is 400,000 MT, down -9% from last year's 440,000 MT.

Another factor for cocoa is smaller cocoa production in Nigeria, the world's fifth-largest cocoa producer. Nigeria's Cocoa Association projects Nigeria's cocoa production will fall -11% yoy to 305,000 MT from a projected 344,000 MT for the 2024/25 crop year.

Demand dips and market reactions

We are now starting to see a drop in demand for chocolate. Chocolate maker Lindt in July lowered its margin guidance for the year due to a larger-than-expected decline in first-half chocolate sales. Also, chocolate maker Barry Callebaut in July reduced its sales volume guidance for a second time in three months, citing persistently high cocoa prices. The company projects a decline in full-year sales volume and reported a -9.5% drop in its sales volume for the March-May period, the largest quarterly decline in a decade.

Weakness in global cocoa demand has been a factor for cocoa prices. The European Cocoa Association reported on July 17 that Q2 European cocoa grindings fell by -7.2% yoy to 331,762 MT, a bigger decline than expected. Also, the Cocoa Association of Asia reported that Q2 Asian cocoa grindings fell -16.3% yoy to 176,644 MT, the smallest amount for a Q2 in 8 years. North American Q2 cocoa grindings fell -2.8% yoy to 101,865 MT, which was a smaller decline than the declines seen in Asia and Europe.

The future for cocoa prices

What does this mean for chocolate prices? We are now starting to see some chocolate prices come down, in some cases by 10-20%. If the cocoa market remains at current levels or drops further we may see further price drops going into 2026 but this will largely depend on the main October crop yields, especially from Ivory Coast and Ghana where 60-70% of the world’s cocoa is grown.

Current cocoa graph below:

[updated 27.05.25]

Cocoa pricing

Cocoa prices have rallied sharply over the past two weeks on quality concerns regarding the Ivory Coast cocoa mid-crop, which is currently being harvested through September. Cocoa processors are complaining about the crop's quality and have rejected truckloads of Ivory Coast cocoa beans. Processors said about 5% to 6% of the mid-crop cocoa in each truckload is poor quality, compared with 1% during the main crop.

However cocoa prices on Friday plummeted to 1-1/2 week lows and settled sharply lower as forecasts for favourable rain in West Africa are expected to aid cocoa crop development in the world's largest cocoa-growing regions. Meteorologist Vaisala said that moderate showers are expected to continue into next week in the cocoa-growing regions of West Africa. Please see latest graph below.

A rebound in current cocoa inventories is also bearish for prices. Since falling to a 21-year low of 1,263,493 bags on January 24, ICE-monitored cocoa inventories held in US ports have rebounded and climbed to an 8-month high on Friday of 2,177,8904 bags.

The poor quality of the Ivory Coast's mid-crop is partly tied to late-arriving rain in the region that limited crop growth. The mid-crop is the smaller of two annual cocoa harvests, which typically starts in April. The average estimate for this year's Ivory Coast mid-crop is 400,000 MT, down -9% from last year's 440,000 MT.

Consumer demand

Concern that consumer demand for cocoa and cocoa products will wane is weighing on prices. On April 10, Barry Callebaut AG, one of the world's biggest chocolate makers, cut its annual sales guidance in the face of high cocoa prices and tariff uncertainty. Also, chocolate maker Hershey Co. recently reported that Q1 sales fell by 14% and said it anticipated $15-$20 million in tariff costs in Q2, which will boost chocolate prices and further weigh on consumer demand. In addition, Mondelez International reported weaker-than-expected Q1 sales and said consumers are cutting back on snack purchases due to economic uncertainty and high chocolate prices.

Cocoa prices also have a positive carryover from recent news that showed better-than-expected global cocoa demand. Q1 European cocoa grindings fell -3.7% y/y to 353,522 MT, a smaller decline than expectations for a -5% y/y drop.

Smaller cocoa supplies from Ghana, the world's second-biggest cocoa producer, are supportive for prices after Cocobod, Ghana's cocoa regulator, cut its Ghana 2024/25 cocoa harvest forecast in December for the second time this season to 617,500 MT, down -5% from an August estimate of 650,000 MT.

The International Cocoa Organization (ICCO), on February 28, said the 2023/24 global cocoa deficit was -441,000 MT, the largest deficit in over 60 years. ICCO said 2023/24 cocoa production fell -13.1% y/y to 4.380 MMT. Looking ahead to 2024/25, ICCO on February 28 forecasted a global cocoa surplus of 142,000 MT for 2024/25, the first surplus in 4 years. ICCO also projected that 2024/25 global cocoa production will rise +7.8% y/y to 4.84 MMT.

Weather concerns in West Africa are also supporting cocoa prices. Despite the recent rains in West Africa, drought still covers more than a third of Ghana and the Ivory Coast, according to the African Flood and Drought Monitor.

The outlook for chocolate prices

What does this mean for chocolate prices?

Belcolade chocolate prices should still drop for Q3 but the market spike back up to £7,500/mt, although short lived, may mean that prices will not drop by much. However we may still see a further drop in Q4 provided the market doesn’t spike again. A lot will depend on the next main October crop forecast. First indications will be in the next few weeks once the flowers start to appear on the trees. However the situation still remains very volatile so nothing is guaranteed.

[updated 02.04.25]

Cocoa exports

The average estimate for this year's Ivory Coast mid-crop (April harvest) is 400,000 MT, -9% below last year's 440,000 MT.

Cocoa prices have been dropping over the past month, with NY cocoa falling to a 4-month low last Friday and London cocoa posting a 4-month low Monday on an improving supply outlook and speculators selling their positions. On February 28, the International Cocoa Organization (ICCO) forecasted a global cocoa surplus of 142,000 MT for 2024/25, the first surplus in 4 years. ICCO also projected that 2024/25 global cocoa production will rise +7.8% yoy to 4.84 MMT.

Nigeria reported on February 27 that its Jan cocoa exports jumped +27% yoy to 46,970 MT. Nigeria is the world's fifth-largest cocoa producer.

Monday's government data showed that Ivory Coast farmers shipped 1.41 MMT of cocoa to ports from October 1 to March 16, up +12% from last year. However, the pace has fallen from the 35% rise seen in December.

Other factors affecting cocoa prices

Demand concerns are also impacting cocoa prices. Executives from chocolate makers Hershey and Mondelez recently warned that high prices are hurting demand. On February 4, Mondelez executives warned of a potential slowdown in chocolate demand when CFO Zarmella said, "We are seeing signs where cocoa consumption is coming down." Also, on February 18, the company warned that chocolate prices could rise as much as 50% due to the surge in cocoa prices, which would curb chocolate demand further. In addition, Hershey executives said on February 6 that high cocoa prices are forcing it to reformulate recipes by replacing cocoa with other ingredients.

Mondelez have taken the decision to reduce the size of their Milka Classic bar from 100g to 90g to avoid a large price increase. In additional Cadbury have announced that their 10 bar pack Twirls will be reduced to 9 bars for the same reason. This is also likely to impact demand.

High cocoa prices reduced cocoa demand in Q4 2024, as seen in the quarterly grinding reports. On January 9, the European Cocoa Association reported that Q4 European cocoa grindings fell -5.3% yoy to 331,853 MT, the lowest in more than 4 years. Also, the Cocoa Association of Asia reported that Q4 Asian cocoa grindings fell -0.5% yoy to 210,111 MT, also the lowest in 4 years. Grinding figures are an indication of demand in the market.

Ghana, the world's second-biggest cocoa producer, cut its 2024/25 cocoa harvest forecast in December for the second time this season to 617,500 MT, down -5% from an August estimate of 650,000 MT.

The ICCO on February 28 said the 2023/24 global cocoa deficit was -441,000 MT, the largest deficit in over 60 years. Therefore the drop in the market has more to do with a fall in demand and speculators selling their positions. ICCO said that 2023/24 cocoa production fell -13.1% yoy to 4.380 MMT. However due to the lower demand the global stock deficit may turn into a small surplus in the 2nd half of 2025 (see surplus/deficit forecast graph below).

Pricing forecast

What does this mean for chocolate prices going forward? Prices will continue to increase for Q2 2025 but, if the current trend continues, we could see prices flatline in Q3 or possibly a modest drop. If the market stabilizes around the £6,000/mt mark we could possibly see a bigger price drop in Q4 2025 once the lower market prices filter through to manufacturers as there is always a lag of around 6 months.

[updated 29.01.25]

Cocoa market update: the outlook

Unfortunately the cocoa market has continued to increase and is currently trading at just over £9,000/mt (as of 22/01/25). To put this into perspective the market had dropped to around £4,500 in June/July last year. As a result chocolate prices will continue to increase in the short term with renewed concerns around supply with slowing Ivory Coast cocoa exports tightening global supplies. Heavy rain in West Africa during the harvesting period has led to reports of high mortality rates of cocoa buds on trees. Heavy rain in the Ivory Coast has also flooded fields, increasing disease risk, and affected crop quality.

Cocoa production

The International Cocoa Association (ICCO) raised its global cocoa deficit estimate to -478,000 MT from May's -462,000 MT, the largest deficit in over 60 years. ICCO also cut its cocoa production estimate to 4.380 MMT from May's 4.461 MMT, down -13.1% yoy. Last Thursday, the European Cocoa Association reported that Q4 2024 European cocoa grindings fell -5.3% yoy to 331,853 MT, the lowest in more than 4 years. This is an indication that demand is also dropping.

Ghana's Cocoa Board (Cocobod) cut its cocoa production estimate to 650,000 MT from a June forecast of 700,000 MT. Due to bad weather and crop disease, Ghana's cocoa harvest sank to a 23-year low of 425,000 MT. Ghana is the world's second-biggest cocoa producer. Nigeria's November cocoa exports rose +35% yoy to 38,015 MT. Nigeria is the world’s 6th largest producer.

The impact on chocolate prices

So what impact will this have on chocolate prices going into 2025? Chocolate prices will almost certainly rise again in Q2 2025 albeit not as high as the 20-35% increases we have seen previously. The increases are likely to be around 8-10% depending on the type of chocolate but this is not confirmed so could be higher. Cocoa powder prices will likely increase more due to the increased demand for compound/imitation chocolate where cocoa powder is used in the recipes. This may lead to availability issues on cocoa powder.

Supply forecast

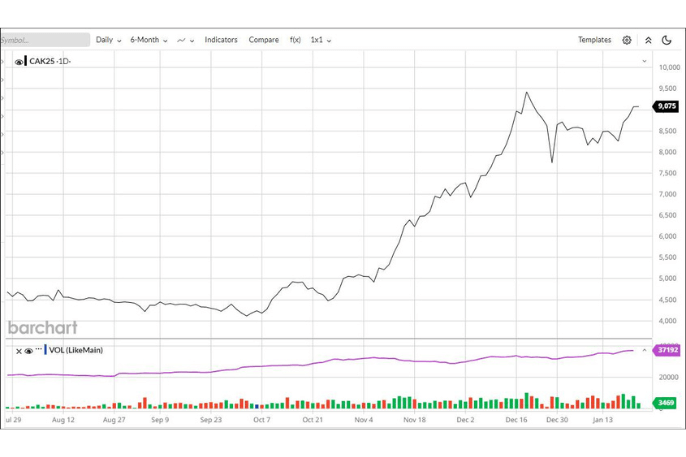

From a supply point of view we have security of supply so we are not anticipating any supply issues on chocolate. Please see below the latest cocoa graph:

Cacao price rates

Cacao price rates[updated 03.12.24]

Cocoa Market Update: What’s happening with prices?

The cocoa market is changing once again, with prices climbing due to growing concerns about crop yields, bean quality, and global supply shortages. Here’s what’s driving the changes and what it might mean for chocolate lovers and producers alike.

Cacao price rates

Cacao price ratesThe weather factor

West Africa, home to the largest cocoa-producing countries like Ghana and Nigeria, is experiencing dry and hot weather. This could impact the upcoming mid-crop, which begins in April. With weather conditions affecting harvests, the industry is bracing for a potential dip in production.

Bean quality matters

Bean quality from the Ivory Coast, the world’s largest cocoa producer, has also come under the spotlight. Recent harvests show higher bean counts—around 105 beans per 100 grams—which signals lower quality compared to the ideal counts of 80–100. This drop in quality adds pressure to the market.

Global stock concerns

Stockpiles of cocoa beans are dwindling, with US cocoa inventories at a 19-year low. Similarly, global stock ratios are tightening, with the International Cocoa Organisation (ICCO) projecting a 46-year low in the global stocks-to-grindings ratio. Shrinking supplies often lead to firmer prices, as seen in recent market trends.

Mixed signals from demand and supply

While cocoa demand remains robust in some regions—North American and Asian cocoa grinding figures are up—European grindings have dipped. On the supply side, there’s a slight silver lining: the pace of cocoa shipments from the Ivory Coast is increasing, and Cameroon’s production is on the rise. However, these factors have not offset the broader concerns about global deficits.

A historic deficit?

The ICCO has raised its global cocoa deficit forecast for 2023/24 to -462,000 metric tonnes, the largest in over 60 years. With lower production estimates and challenges in key regions like Ghana, where the harvest hit a 23-year low last season, the market remains under pressure.

What does this mean?

For now, these dynamics are keeping cocoa prices on an upward trajectory. For chocolate enthusiasts, it’s a reminder of how the journey from bean to bar is influenced by a complex interplay of factors—from weather and quality to global demand and supply.

We’ll continue to keep an eye on the cocoa market and share updates as they unfold. On a personal note, we’re pleased to share that going into the new year our Callebaut and Belcolade pricing will remain at the current rate for as long as possible – so now’s your chance to stock up! Stay tuned for more insights into the world of cocoa and its impact on the delightful treats we all love!

[updated 15.08.24]

Movements within the cocoa market

Although the cocoa market has dropped back from the peak we saw in April where the market was over £9,000/mt it is still very high and extremely volatile. This is likely to continue for many months to come as the industry has very little contract cover due to reluctance to cover long term whilst prices are still very high. Historically the average industry cover has been around 9-12 months but is currently only averaging around 6 months. This creates volatility where some cover is taken when there is a drop in the market which then has the effect of pushing the market up higher. In the last three months the market has hovered between £6,000 - £7,000/mt.

Historically prices for booking future contracts have always been higher but we are still seeing an inverted market where future prices are lower than current price periods which suggest the market believes that prices will come down in the long term. An inverted market points to a risk in the short term, in this case the availability of beans. It could correct either way: to come down as the risk reduces (eg good crops) or the future positions might increase as we get closer to those positions. However, this will very much depend on the next harvests from the Ivory Coast and Ghana which will be around October. Cocoa arrivals from the Ivory Coast are still 25-30% down and even a good harvest will not cover the current deficit. In addition we are not really seeing a slowdown in demand because grinding figures are only down 2-3% despite the very large price increases, whilst the largest price increases are still to hit the consumer market. Some market analysts are predicting that the market could move back into a surplus position late 2025 into 2027.

Harvest predictions

Early indications from The Ivory Coast point towards a good crop compared to recent crops. The trees have plenty of flowers but adverse weather conditions between now and October could still prevent the flowers from fully developing into pods. We will not know for sure how good the crop will be until around the end of October/early November once actual arrival figures come in. In addition the European Union's upcoming Deforestation-free Regulation will also ban imports of cocoa produced on recently deforested land, posing a challenge for West African farmers who rely heavily on the European market. This regulation aims to curb deforestation but adds complexity and costs to the supply chain and may also increase prices further.

What does this mean for chocolate prices?

Due to the currently volatility of the market and continued concerns over supply, chocolate prices are likely to increase further into Q4 2024. They could possibly flatline in Q1 2025 but this is by no means guaranteed. Beans from the October harvest will reach Europe as of January 2025 so if the harvest is good we may see prices drop a bit from Q2 2025. Nestle and Mondelez are expecting a drop in consumer demand next year once high prices arrive in the consumer market. If global demand does drop we may see prices fall further. Prices for milk and white chocolate will increase more in the short term due to the cocoa butter ratio which is currently around 4.3. The butter ratio is the premium paid for cocoa butter compared to the market price of cocoa beans. As milk and white chocolate contain more cocoa butter than dark chocolate we can expect milk and white chocolate prices to increase more than dark chocolate.

[07.03.24]

Chocolate price rises explained

It’s impossible not to notice that the price of chocolate has risen exponentially over the last 12 months.

As one of the UK’s biggest chocolate distributors, we felt it was important to give you an update on the current trading situation and share our predictions on how we expect the market will perform in the coming year to help you make informed decisions.

Here, Steve Calver, Commercial Director at Henley Bridge with over 30 years’ expertise tracking the cocoa markets, shares his knowledge and expertise…

What affects chocolate pricing?

Chocolate is a commodity and therefore its price fluctuates based on supply and demand.

Factors such as global production levels, weather conditions and crop disease play significant roles in shaping price trends. For instance, lower cocoa production in major growing regions, like the Ivory Coast and Ghana, due to adverse weather conditions can contribute to tighter market conditions and influence prices.

Growing demand for real chocolate from emerging countries, such as India and China, has also contributed to increased pressure on the commodity market.

The current situation

Cacao pricing is experiencing a historical high. Figures released this month reveal that raw cacao prices have reached a record high of £4,700 per tonne, significantly more than double the price it was in February 2023 which was around £1,900 per tonne.

There are two cocoa crops a year – in May and October – and the next crop is expected to be affected by the El Nino weather pattern, resulting in drier weather conditions in Africa where 75% of the world’s cacao is grown.

Cacao price rates

Predictions for this year

Chocolate prices unfortunately look set to remain at a record high for the whole of 2024.

Price increases of 15-20% are likely for the first half of 2024 - and could potentially be replicated during the second half of the year.

Colour co-ordination

Dark chocolate was historically cheaper than milk or white chocolate (which contains more sugar and milk powder) but this trend has been completely reversed from an ingredients perspective with dark chocolate now commanding the same or similar pricing.

2025 and beyond

Examining market analysis and future projections, it’s predicted that prices could start to fall as we move into 2025/6. Due to the high cost of real chocolate, some markets may go back to using imitation chocolate which would, in turn, reduce demand, but that’s just pure speculation at this stage.

What is Henley Bridge doing to help?

From a distributor perspective, the commercial team at Henley Bridge is working hard to try and soften the blow for customers.

We held off price increases until February 1, delaying the increase by one month, and are stocking up where possible to hold off further price increases.

We’re also trying to give a one month notice period of any impending price increases to give customers time to react.

What can customers do?

Chocolate prices rises can be addressed in two ways. You can either pass on the increases to your customers by upping the price of your products, or, as we have seen with large manufacturers, adopt the ‘shrinkflation’ method, in other words, make smaller products but sell them for the same price.